Comprehensive Curriculum

Everything you need to become a successful residential lender, structured for optimal learning

Licensing Requirements & Key Regulators

Learn the licensing rules and the role of key regulators. Stay compliant and navigate the industry with confidence.

Direct Lender vs Broker: Pros & Cons

Understand the benefits and differences between them. Choose the best path for your lending career.

Prequalification & Credit Analysis

Master prequalification and credit analysis steps. Help clients get approved with accurate assessments.

Income Verification & Asset Documentation

Verify income and document assets for approval. Ensure accurate and compliant loan submissions.

Mortgage Calculators & Affordability Tools

Use calculators to determine affordability. Guide clients to the right mortgage solutions.

Loan Registration & Disclosure Requirements

Navigate registration and disclosure rules. Stay transparent and build client trust.

Appraisal, Underwriting & Conditional Approvals

Understand the appraisal and underwriting process. Navigate conditional approvals with expertise.

Title & Escrow Process Fundamentals

Learn title search and escrow essentials. Ensure smooth closings and protect client interests.

Closing Process & Post-Closing Obligations

Master the closing process from start to finish. Fulfill post-closing duties professionally.

Interest Rates, Market Trends & Economic Factors

Analyze rates and market trends. Advise clients with data-driven insights.

Conventional, FHA, VA & USDA Loan Programs

Explore major loan programs and their requirements. Match clients with the right financing options.

Compliance, Fair Lending & RESPA

Ensure compliance with fair lending laws. Build a reputation for ethical practices.

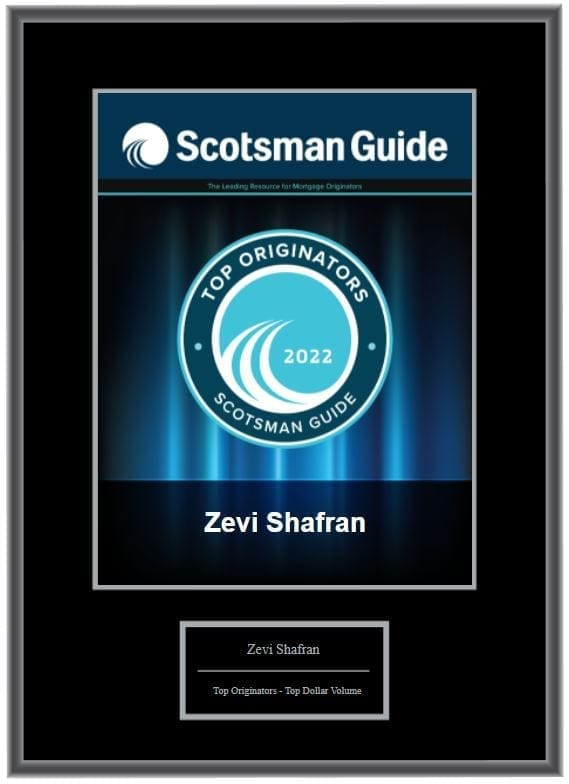

Zevi Shafran is the owner of Loan Brook in Los Angeles and brings over 15 years of experience in the mortgage industry. Beyond running a successful brokerage, he’s also a YouTube mortgage influencer with 35,000 subscribers, where he shares insights that have helped thousands better understand lending and real estate finance.

To give aspiring loan officers a clear, practical path forward, Zevi created the Part-Time Residential Lender Academy—a step-by-step program designed to help you build confidence, sharpen your skills, and succeed in the mortgage industry. Whether you’re just starting out or looking to take your career to the next level, this academy equips you with the knowledge and tools to grow.

Ron L.

"I just purchased a new house after trying to get a loan from Chase Bank, but they couldn’t make it happen. I reached out to Loan Brook and spoke with Zevi, who made the process so easy. It was a pleasure working with him—highly recommended!"

Gayle E.

"I needed to get a loan of $1,700,000 to win the bid on a house. Within the ten day time limit, Zevi was able to secure this loan for me. He was amazing, and very resourceful. After the sale closed, Zevi immediately converted this loan to a traditional 30 year mortgage."

Ronnie G.

"Thanks again for doing the impossible. I never thought I could be approved for a loan again, but you did it! Every loan you make me feel safe, explain the whole process, and make it much easier! Thanks ! I highly recommend working with Zevi and the team!"

Ready to Transform Your Career?

Join many successful graduates who have launched their residential lending careers through our proven program

Flexible Schedule

Learn at your own pace with part-time commitment.

Expert Instructors

Learn from industry professionals with years of experience.

Career Ready

Graduate with the skills to succeed in residential lending.

Enter your information to receive the exclusive pre-launch discount code 🎓

Step-by-step guidance to start your part-time lending career — delivered in both video and text format.

We HATE spam. Your email address is 100% secure

"Part-Time Residential Lender Academy"

Receive a Pre-Launch Discount Code 🚀

Enter your information to receive a pre-launch discount code to the Part-Time Residential Lender Academy! 🎓

We HATE spam. Your email address is 100% secure